How to Be DPDP Compliant: A Guide for Small Businesses

DPDP compliance often feels like a legal ghost story – complex, terrifying, and expensive, because it is often explained like a legal theory, not an operational task.

Most SMEs collect customer data daily – leads, invoices, KYC documents, support tickets – without real visibility or control. The result is silent risk.

If your business treats customer data like a junk drawer, you aren’t just disorganized; you’re a walking liability.

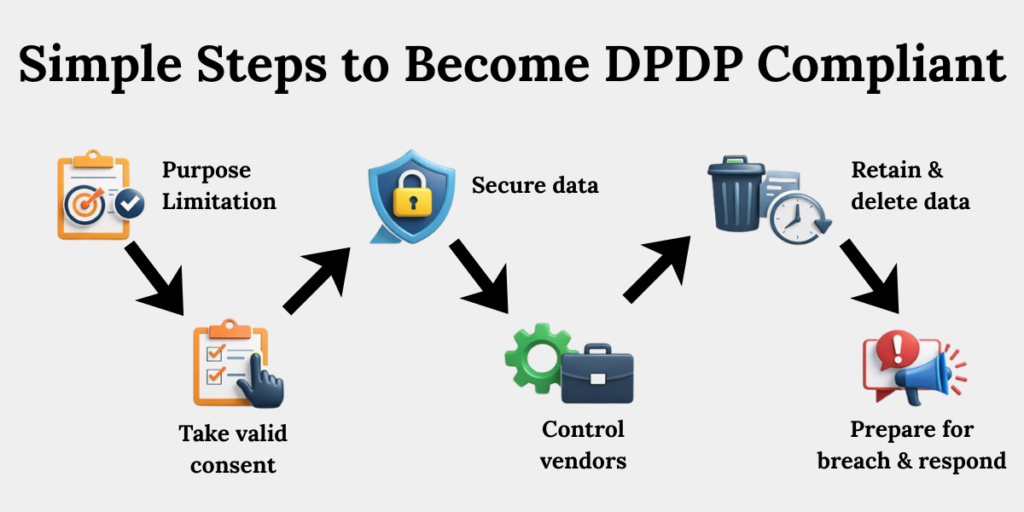

This guide breaks DPDP compliance into a clear, step-by-step blueprint you can actually execute.

Why DPDP Compliance Is Harder for Small Businesses

DPDP compliance is challenging for small businesses because data handling is informal, undocumented, and spread across tools. Unlike enterprises, SMEs lack dedicated privacy teams yet face the same legal obligations. Regulators do not lower expectations for size – they demand clarity of purpose, valid consent, and reasonable safeguards regardless of your annual turnover or employee count.

Small businesses run lean. Data decisions are made for speed, not governance.

That works – until it doesn’t.

Most SMEs don’t fail DPDP because of intent. They fail because data flows are invisible and ownership is unclear.

If you can’t map where a customer’s phone number goes after they hit “submit,” you are in the red zone.

What DPDP Actually Expects from Small Businesses

The DPDP Act, 2023 does not expect small businesses to build enterprise-grade privacy programs. It expects clarity of purpose, valid consent, basic security safeguards, and documented accountability. If you can explain what data you collect, why you collect it, who can access it, and when it is deleted – you are already halfway compliant.

Think of DPDP as architecture, not paperwork.

A simple structure beats a thick policy nobody follows.

Step 1: Define Why You Collect Data (Purpose Limitation)

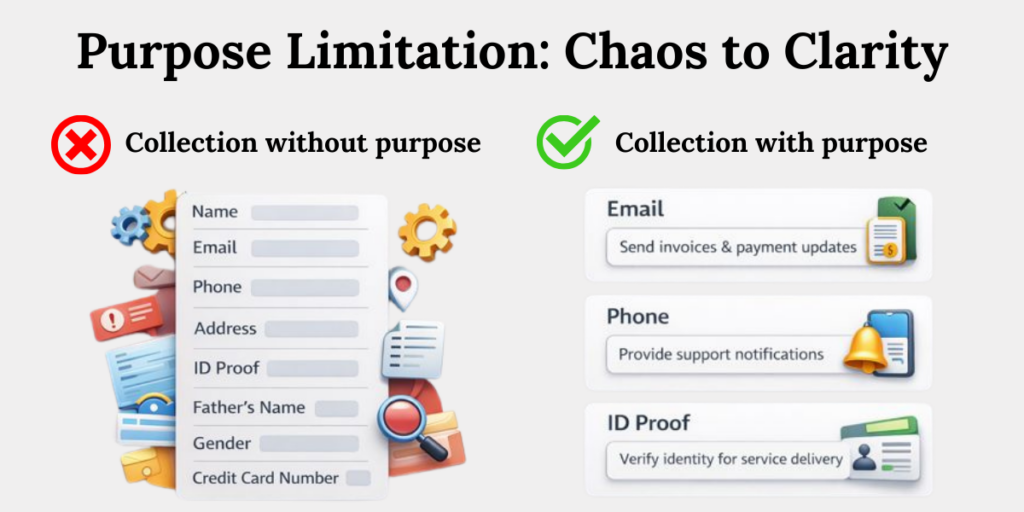

DPDP requires small businesses to collect personal data only for a clear, specific purpose and restrict its use to that purpose. “Just in case” data collection creates unnecessary exposure. Every form, CRM field, and spreadsheet should have a defined business reason tied to customer communication or service delivery.

[Source: DPDP Act, 2023, Section 5(Notice & Purpose)]

Purpose Limitation in Practice

Think of purpose as the foundation of your architecture. Without it, every other control collapses.

Inventory your intake. If a data point doesn’t help you ship a product or provide a service, it’s a liability you don’t need.

What to do immediately

- List all data you collect from customers and leads

Start by identifying every place where data enters your business. This includes website forms, CRM tools, email lists, invoices, support tickets, WhatsApp chats, and spreadsheets.Create a simple list of what data you collect – name, phone number, email, address, ID proof, payment details – and note where it is stored. - Define the exact purpose for each data type

For every data item,clearly write why you need it. Keep the purpose specific and business-related. For example, collect an email address for billing or support—not for “future marketing” unless you have separate consent. - Remove fields that have no current business use

Review your forms and systems and delete data fields you no longer use. If a field does not support sales, service, legal, or operational needs today, it creates risk without value

SMEs can reduce their risk profile by 30-40% simply by deleting data they never should have collected in the first place.

Step 2: Take Clear and Verifiable Consent

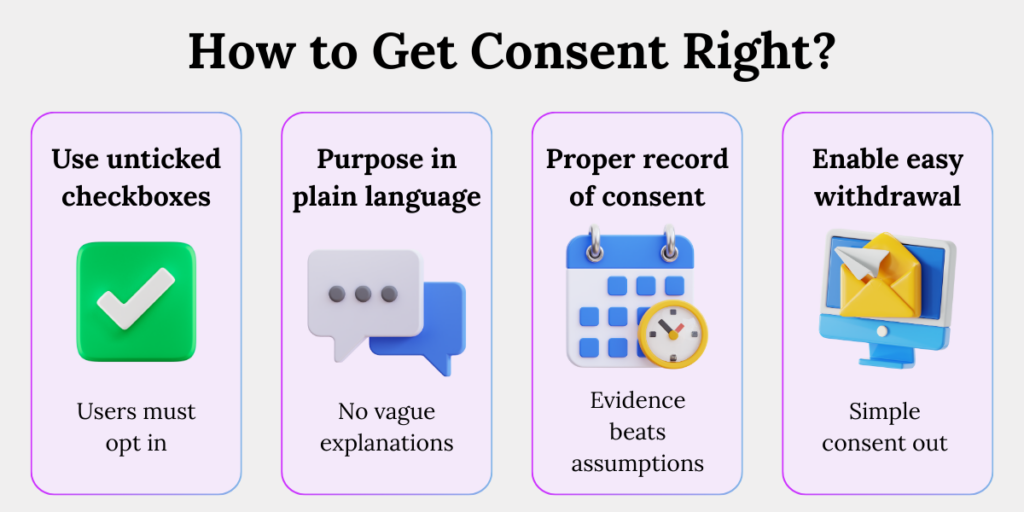

DPDP requires consent to be free, informed, specific, and easy to withdraw. Pre-ticked boxes, bundled permissions, or vague language do not qualify. Small businesses must be able to show when consent was taken, for what purpose, and how users can revoke it without friction.

[Source: DPDP Act, 2023, Section 6 (Consent)]

Consent is your legal shield. Weak consent cracks under scrutiny.

How small businesses get this right

- Use unticked checkboxes on forms

Always let users actively choose to give consent. Checkboxes should be empty by default, so the user has to tick them themselves. Pre-ticked boxes or auto-consent do not count as valid consent under DPDP - State purpose in plain language

Tell users exactly why you are collecting their data, using simple words. Avoid vague lines like “for business purposes.” Instead, say things like “to contact you about your enquiry” or “to send invoices and payment updates.” - Record date, channel, and purpose of consent

Keep a basic record of when consent was given, how it was collected, and what it was for. This includes the exact date and time, whether it came from a website form, email, or WhatsApp, and which version of your privacy notice the user agreed to. - Enable easy withdrawal via email or link

Make it simple for users to withdraw consent at any time. This can be an unsubscribe link in emails or a clear email address where users can request removal. Do not hide this option or make users explain their reasons.

If you cannot prove consent, regulators assume it never existed.

Step 3: Secure Data with “Reasonable Safeguards”

DPDP does not mandate advanced cybersecurity tools for small businesses. It requires reasonable safeguards – access control, basic encryption, activity logging, and breach readiness. The standard is contextual: what is reasonable depends on data sensitivity, volume, and business scale, not budget excuses.

[Source: DPDP Act, 2023, Section 8(Reasonable Security Safeguards)]

Security is not about buying tools. It’s about closing obvious doors.

Minimum safeguards SMEs should implement

- Restrict access by role, not convenience

Give employees access only to the data they need to do their job. Sales teams don’t need full customer ID documents. Support teams don’t need payment details. Remove access when roles change or employees leave. - Encrypt data at rest and in transit where feasible

Encryption means data is locked and unreadable if someone gains unauthorised access. Use basic encryption already available in most tools – HTTPS for websites, encrypted databases, and secure cloud storage. You don’t need advanced tools to meet this requirement. - Log who accessed sensitive data

Keep asimple record of who accessed sensitive data and when. Most CRMs, cloud drives, and accounting tools already provide access logs. Turn these on so you can trace activity if something goes wrong. - Prepare a basic breach response plan

Decide in advance what you will do if data is leaked or accessed wrongly. Identify who investigates the issue, who informs users, and who reports to authorities. A simple written plan is enough.

Step 4: Control Vendors Before They Control Your Risk

Under DPDP, small businesses remain responsible for personal data shared with vendors. Payment gateways, CRM tools, marketing platforms, and cloud services all become risk multipliers. DPDP expects basic due diligence, contractual safeguards, and visibility into how vendors process and store personal data.

[Source: DPDP Act, 2023, Section 8(Processor & Vendor Accountability)]

Vendors are part of your defence perimeter, whether you like it or not. Blind trust on vendors is not a compliance strategy. It’s a gamble with your company’s future.

Vendor controls that actually matter

- List all tools that access personal data

Write down every tool and service your business uses that touches customer or lead data. This includes CRMs, email tools, payment gateways, cloud storage, accounting software, marketing platforms, chat tools, and even shared spreadsheets - Check where data is stored and processed

Find out which country your data is stored in and processed from. Most tools mention this in their privacy policy or account settings. This matters because DPDP holds you responsible even when data sits with a third party. -

Add clauses for breach reporting and data deletion

Make sure your vendor contracts clearly state that:- They must inform you promptly if a data breach occurs.

- They must delete your data when the contract ends or when you request it.

- Disable unused tools and APIs Remove access to tools you no longer use and turn off old integrations or API connections. Unused tools often still hold data and remain exposed, even though no one remembers them

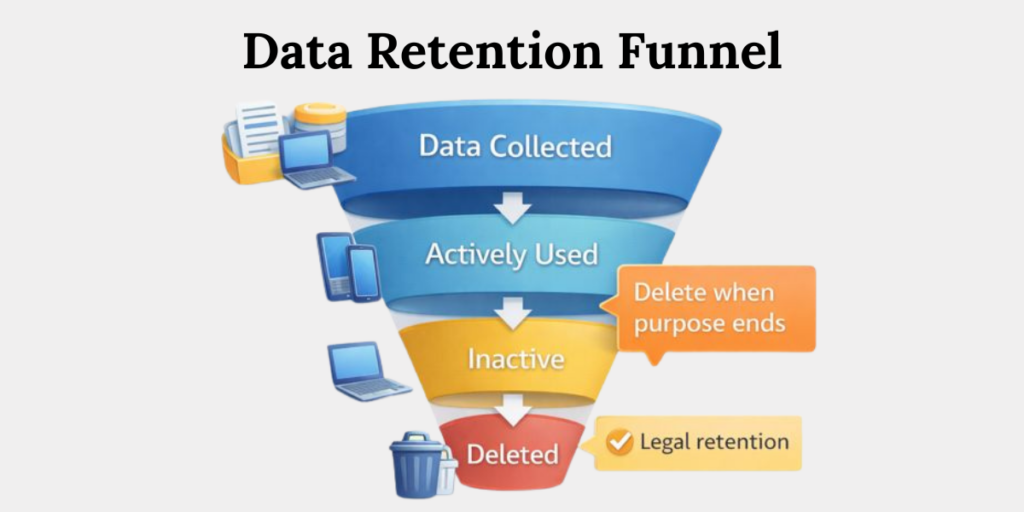

Step 5: Delete Data on Time (Data Retention & Deletion)

DPDP requires personal data to be deleted once the purpose is fulfilled, unless retention is legally required. Keeping old customer data “just in case” increases liability without business value. Small businesses must define retention timelines and operationally enforce deletion across systems.

[Source: DPDP Act, 2023, Section 12(Right to Erasure & Retention]

Data hoarding is a habit worth breaking.

Erase the past to protect the future. Less data equals less exposure. Always.

Practical retention discipline

- Define retention periods per data type

Decide how long you really need each type of data. For example, keep invoices for legal or tax reasons, but delete marketing leads after a fixed period of inactivity. Write this down so the rule is clear and consistent. - Schedule periodic data clean-ups

Set a regular schedule – monthly or quarterly – to review and delete old data. This can be a simple calendar reminder to clean up CRMs, email lists, shared drives, and folders where personal data is stored. - Erase inactive leads and closed accounts

Remove data of leads that have not responded for a long time and customers whose accounts are closed. If there is no active relationship or legal requirement, keeping this data only increases risk. - Document why any data is retained longer

If you keep data beyond your normal timeline, write down the reason. This could be a legal obligation, an ongoing dispute, or a regulatory requirement. A simple note is enough.

Less data equals less exposure. Always.

Step 6: Be Ready to Respond (Breach Response & Grievance Redressal)

Rule 7 of the DPDP Rules, 2025 requires businesses to respond to user grievances and notify authorities of data breaches within prescribed timelines. Small businesses must publish contact details, track complaints, and maintain a simple breach notification process. Silence or delay is viewed as negligence, not ignorance.

Response readiness is your last line of defence.

What readiness looks like

- Publish a grievance contact (email or form)

Clearly share one contact point where users can raise data-related complaints or requests. This can be a dedicated email address or a simple form on your website. Make sure it is easy to find in your privacy notice or footer. - Acknowledge requests promptly

Reply to every complaint or request as soon as you receive it, even if the issue will take time to resolve. A simple acknowledgment message shows that the request is being handled and reduces escalation risk. - Escalate internally with clear ownership

Decide who inside your business is responsible for handling data complaints and breaches. This could be a founder, operations head, or compliance lead. Everyone should know who owns the issue. - Notify authorities within required timelines

If a data breach occurs, inform the relevant authority within the legally required time after becoming aware of it. Delaying or hiding a breach often leads to higher penalties than the breach itself.

Conclusion:

DPDP compliance isn’t about fearing the ₹250 crore penalty.

It is about building trust into your business architecture.

Small businesses that treat privacy as a roadmap – not a reaction – move faster, safer, and with confidence.

Start simple. Document decisions. Fix the obvious gaps. Compliance, done right, becomes a business advantage – not a burden.

Master the basics, stay consistent, and DPDP compliance becomes manageable.