Why DPDP Compliance Matters in BFSI

BFSI handles money – but first, it handles trust.

That trust is built on personal and financial data: KYC records, transaction histories, credit profiles, behavioural signals.

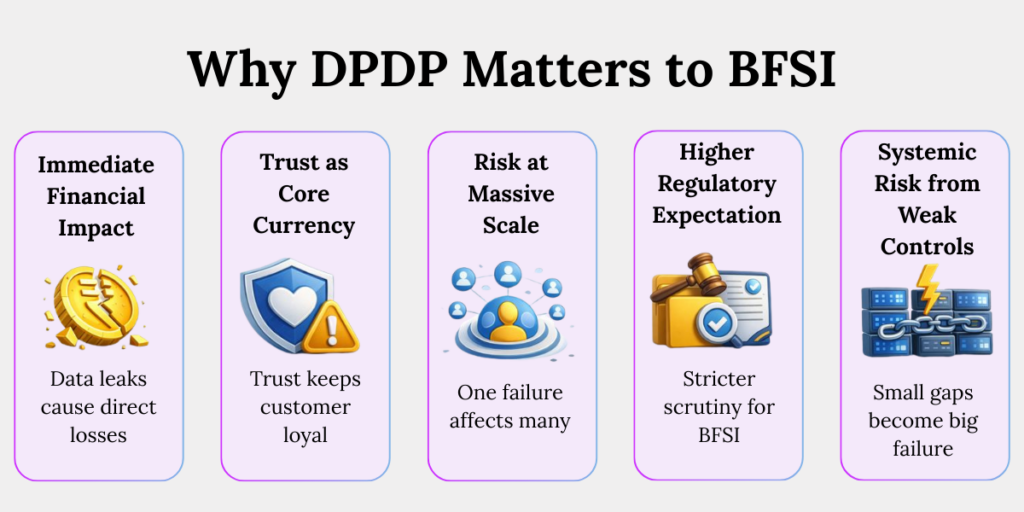

In BFSI, one data leak can cost crores of rupees – in fines, fraud losses, remediation, and long-term reputational damage. DPDP compliance is no longer a legal formality. It is a business survival requirement.

This blog explains why DPDP matters uniquely for BFSI, where institutions actually fail in practice, and what regulators now expect organisations to fix.

Why is DPDP compliance important for BFSI Sector?

DPDP compliance is especially important for banks, NBFCs, and fintech because they process highly sensitive financial and identity data at massive scale. A single control failure can impact thousands of customers at once, triggering regulatory scrutiny, fraud risk, and permanent loss of trust. Regulators therefore expect stronger governance from BFSI than most other sectors.

BFSI data is different.

It doesn’t just identify people – it affects their financial lives.

In practice, BFSI organisations routinely handle:

- KYC documents and identity proofs

- Account numbers and detailed transaction logs

- Credit scores, repayment behaviour, insurance data

When this data is exposed or misused, the harm is immediate and often irreversible. That is why DPDP treats BFSI data failures as systemic governance issues, not minor IT lapses.

What data protection problems exist in the BFSI sector?

DPDP addresses long-standing BFSI data protection problems such as excessive data collection, indefinite retention, uncontrolled internal access, and weak oversight of vendors. The law forces organisations to take responsibility for why data is collected, who can access it, how long it is retained, and how breaches are handled.

Most DPDP risks in BFSI are not sophisticated cyberattacks.

They are the result of everyday business habits.

In real-world BFSI operations, a few issues show up repeatedly, including:

- Too many employees have access to customer data they don’t need

- Customer data is kept even after accounts become inactive

- Vendors handle sensitive data without enough ongoing checks

- Customer data is spread across multiple systems with no clear ownership or single view

- Access and consent controls are weak and not consistently enforced

- Breach detection and customer response processes are slow or unclear

DPDP changes this by fixing accountability on the Data Fiduciary – the organisation that decides to collect and use the data.

That responsibility cannot be outsourced.

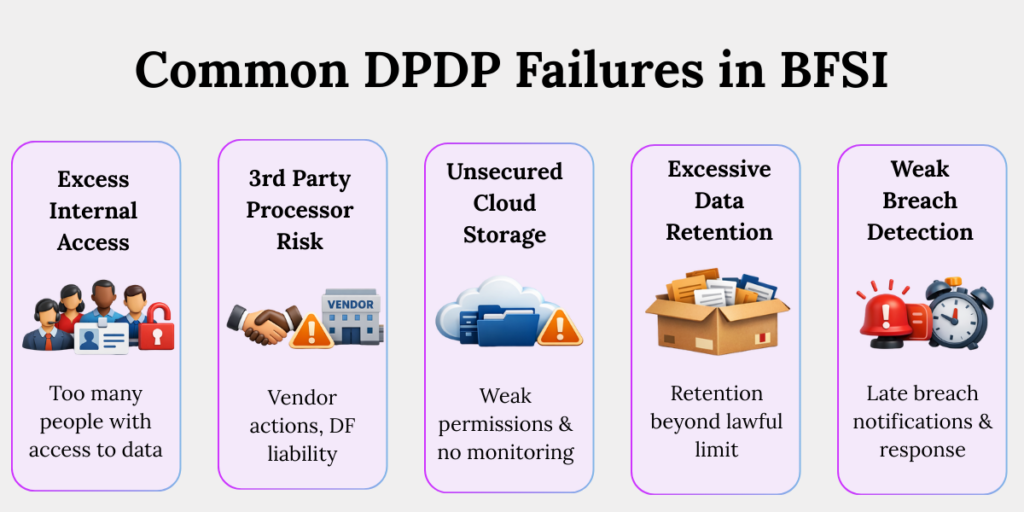

Common DPDP compliance failures in BFSI organisations

Most DPDP compliance failures in BFSI arise from operational weaknesses, not legal gaps. These include excessive internal access, poor vendor oversight, cloud misconfigurations, over-retention of data, and slow breach detection. Each failure increases customer harm and regulatory exposure, even if there is no malicious intent.

Below are the most common failure patterns we see.

1.Excessive internal access (weak RBAC)

What goes wrong:

In many BFSI organisations, internal systems are built for speed rather than restraint. Teams such as sales, operations, support, and collections often receive broad access to full KYC and transaction data because “they might need it.” Over time, access accumulates and is rarely reviewed or revoked.

Why this violates DPDP:

DPDP requires access to be limited to what is necessary for a specific purpose. Broad internal access:

- Breaches data minimisation

- Fails the requirement of reasonable security safeguards

- Increases the risk of insider misuse and accidental exposure

DPDP lesson:

Access must be role-based, purpose-bound, and logged. Convenience is not a lawful basis.

2. Third-party KYC and fintech processor risk

What goes wrong:

Banks and NBFCs frequently rely on external vendors for KYC verification, loan processing, analytics, and payment services. Data is shared, but visibility into how it is accessed, stored, or further shared often stops after onboarding.

Why this violates DPDP:

DPDP makes it clear that the Data Fiduciary remains responsible for processing done on its behalf. If a processor mishandles personal data:

- Regulatory responsibility does not shift

- The fiduciary remains accountable

DPDP lesson:

If a vendor processes your customer data, their failure becomes your liability.

3. Unsecured cloud storage and misconfiguration

What goes wrong:

Operational teams store KYC images, reports, or logs on cloud storage intended for internal use. Permissions drift over time. Monitoring is not enabled. Data becomes accessible to more users – or systems – than intended.

Why this violates DPDP:

DPDP does not distinguish between malicious breaches and accidental exposure. Poor configuration:

- Fails reasonable security safeguards

- Exposes data beyond its lawful purpose

- Creates silent, long-running risk

DPDP lesson:

Misconfiguration is not an accident. It is a compliance failure.

4. Excessive data retention (“just in case” storage)

What goes wrong:

BFSI firms retain old KYC documents, dormant account data, and historical transaction logs because deleting data feels risky. Over time, the organisation forgets why the data exists but continues to store it.

Why this violates DPDP:

DPDP requires personal data to be retained only as long as it serves a lawful purpose. Over-retention:

- Breaches purpose limitation

- Increases breach surface area

- Creates liability without business value

DPDP lesson:

Data without purpose is pure risk

5. Weak breach detection and delayed response

What goes wrong:

Logs are fragmented across systems. Alerts are missed. Teams debate whether an incident is “serious enough” to escalate. By the time leadership is informed, damage has already spread.

Why this violates DPDP:

DPDP Rules require timely breach identification, notification to affected Data Principals, and retention of logs for investigation. Delay directly increases harm and regulatory exposure.

DPDP lesson:

Speed matters. Delay compounds damage.

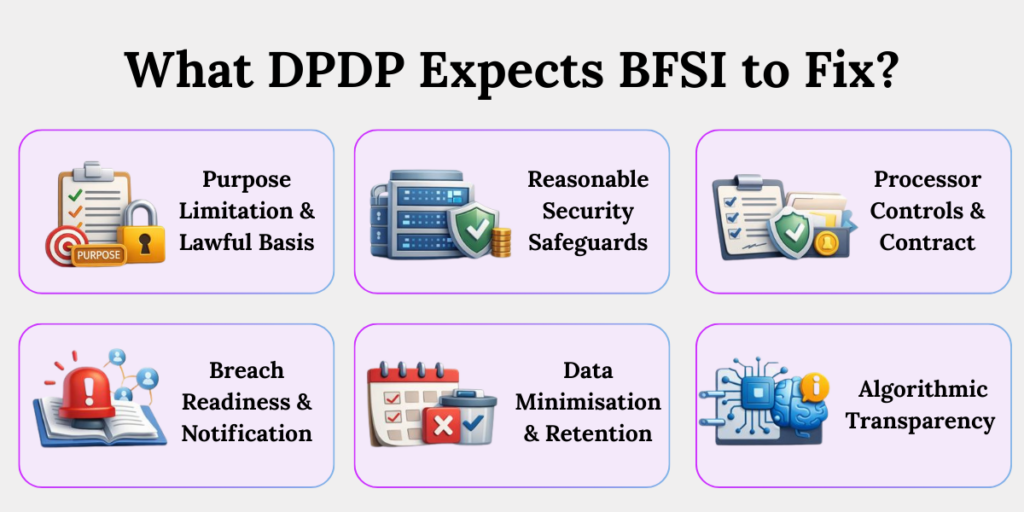

What DPDP Expects BFSI organisations to fix

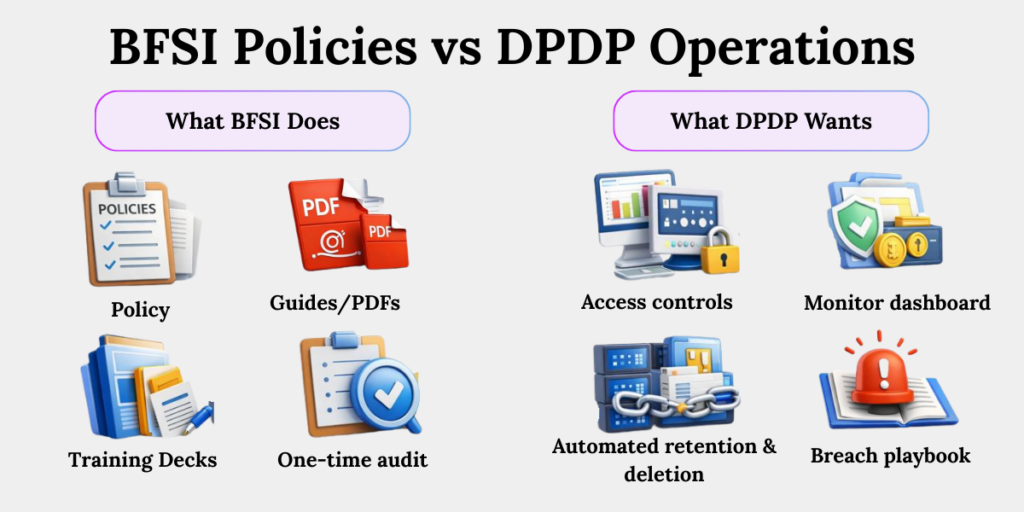

DPDP expects BFSI organisations to operationally enforce purpose limitation, reasonable security safeguards, vendor accountability, breach readiness, and disciplined data retention. This is not about updating policies. It is about changing how data is classified, accessed, monitored, and deleted across systems and vendors.

Here is what that looks like in practice.

1. Purpose limitation and lawful basis

Fix: Clearly define why each category of data is collected and restrict its use to that purpose.

Example: KYC data collected for account opening should not be freely used for marketing or analytics unless lawfully justified and documented.

2. Reasonable security safeguard

Fix: Implement practical controls such as RBAC, encryption, MFA, logging, and regular security testing.

Example: Relationship managers view masked data, while full KYC access is limited to compliance or risk teams.

3. Processor controls and contracts

Fix: Conduct vendor due diligence and include enforceable security, audit, and breach-notification clauses in contracts.

Example: A KYC vendor must notify the bank within defined hours of any incident and allow compliance audits

4. Breach readiness and notification

Fix: Prepare incident-response playbooks, escalation paths, and notification templates in advance.

Example: When a breach occurs, teams know exactly who informs regulators, customers, and leadership – without confusion.

5. Data minimisation and retention

Fix: Define retention periods and automate deletion wherever possible.

Example: Dormant account KYC data is deleted after regulatory timelines instead of remaining indefinitely in legacy systems.

6. Algorithmic transparency (for SDFs)

Fix: Document how automated systems affect customers and ensure explainability for material decisions.

Example: If loan approvals are automated, the organisation should be able to explain the key decision factors.

Why Should BFSI Be DPDP Compliant?

Effective DPDP compliance helps BFSI organisations reduce regulatory risk, lower fraud exposure, preserve customer trust, streamline audits, and safely deploy advanced analytics and AI. Strong data governance acts as a business enabler, not a constraint.

In practical terms, compliant organisations benefit from:

- Avoiding fines and legal costs

Fewer enforcement actions, investigations, and post-breach remediation expenses. - Reducing fraud and financial loss

Tighter access controls and monitoring reduce insider misuse and data-driven fraud. - Preserving customer trust and NPS

Customers stay with institutions that protect their financial identity. - Faster audits and regulator confidence

Clear governance shortens audits and improves supervisory outcomes. - Enabling safe innovation

Clean, well-governed data allows adoption of AI and analytics without hidden compliance risk.

Conclusion:

In BFSI, DPDP compliance protects customers and the business.

It determines whether a data incident becomes a contained issue – or a headline crisis. Organisations that know where their data sits, why it exists, and who can access it are already ahead.

The law has changed.

The real question is whether your data governance has changed with it.

Key Takeaways

- DPDP compliance matters more in BFSI because financial and identity data exposure causes immediate and irreversible harm at scale.

- Most BFSI data protection risks come from everyday practices, not sophisticated cyberattacks or rare edge cases.

- Common DPDP failures in BFSI are operational, driven by weak access controls, poor vendor oversight, over-retention, and slow breach response.

- DPDP expects real system-level fixes, not policy updates—purpose limitation, security safeguards, vendor accountability, and breach readiness must work in practice.

- Strong DPDP compliance protects both trust and growth, reducing regulatory risk while enabling safe innovation and long-term customer confidence