DPDP Penalties: What They Are and How to Avoid Them

The Digital Personal Data Protection Act, 2023 is a positive step toward building a privacy-first digital economy in India.

Penalties under the DPDP Act are not meant to punish arbitrarily — they exist to enforce discipline, deter negligence, and strengthen data protection practices across organisations.

Still, many businesses struggle with the same questions: When do DPDP penalties apply? How does the Data Protection Board decide how much to impose? And how can organisations avoid these DPDP fines?

This blog explains how DPDP penalties work, how they are decided, and how organisations can avoid them.

Why DPDP Penalties Are a Big Deal?

DPDP penalties exist to change behaviour.

Earlier, data protection often remained a checkbox exercise with minimal consequences for failure. DPDP penalties have shifted behaviour by making poor data practices expensive and visible.

They are designed to ensure that personal data protection is treated as a core business responsibility, not a box-ticking exercise.

Under the DPDP Act:

- Financial penalties can be imposed even without malicious intent

- Operational negligence is sufficient to attract liability

- Repeated or systemic non-compliance significantly increases exposure

In practical terms, this means:

- Poor internal controls become regulatory risks

- Weak documentation becomes a liability

- Delayed responses amplify penalties

- Not being ready for incidents draws more regulator attention

- When no one owns compliance, failures increase

This is no longer about compliance optics. This is about taking responsibility and earning people’s trust.

Section 33: The Legal Authority of DPDP Penalties

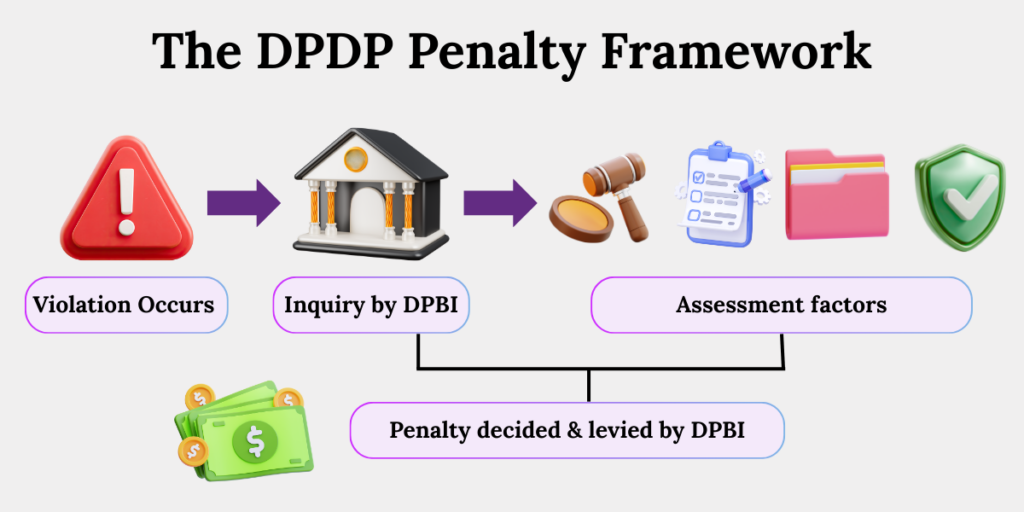

Section 33 of the DPDP Act gives the Data Protection Board of India the power to impose monetary penalties for non-compliance.

In simple terms, Section 33 explains when penalties can be imposed and who decides them. Importantly,

under Section 33,

- Penalties are not automatic

- Organisations are given a reasonable opportunity to be heard

- Decisions must be recorded and reasoned

- Penalties are not automatic

- Organisations are given a reasonable opportunity to be heard

Decisions must be recorded and reasoned.

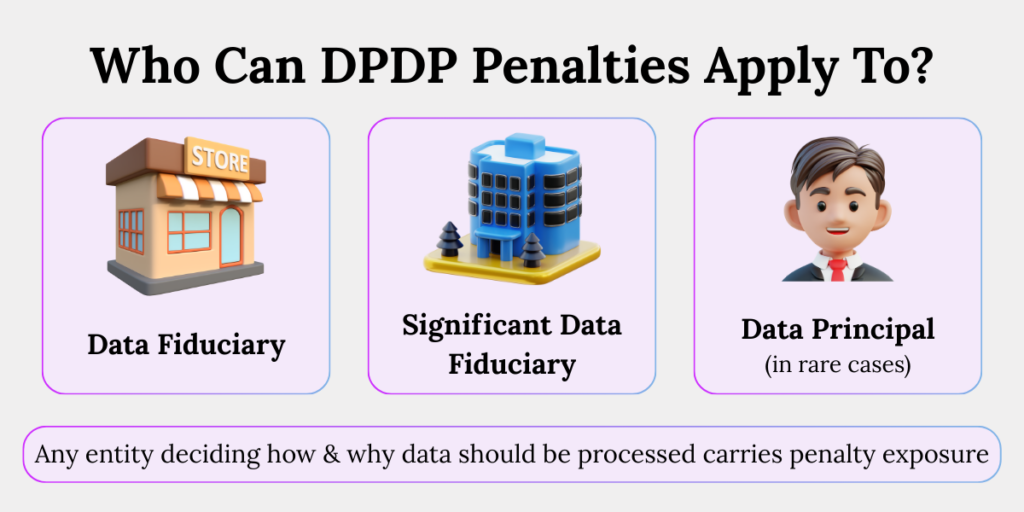

Who Does DPDP Penalties Apply To?

Penalties under Section 33 can be imposed on:

- Data Fiduciaries – entities determining the purpose and means of processing data

- Significant Data Fiduciaries (SDFs) – entities with heightened obligations due to large volume and sensitivity of data

- Individuals, in limited and specific circumstances

Basically, if an entity controls why and how personal data is processed, it carries penalty exposure.

When Can DPDP Penalties Be Imposed?

1. Trigger: Breach of the DPDP Act

Penalties may arise from:

- Failure to comply with statutory obligations

- Violation of DPDP Rules

- Inadequate safeguards leading to personal data breaches

- Non-compliance with special obligations (children’s data, SDF duties)

The Board does not require intent.

Impact, risk, and negligence are sufficient.

2. No Automatic Punishment

Before imposing a penalty, the Board must:

- Conduct a formal inquiry

The Data Protection Board examines the facts, the nature of the violation, and the surrounding circumstances before reaching any conclusion. - Offer a reasonable opportunity to be heard

The organisation is allowed to present its explanation, evidence, and mitigation steps. - Issue a reasoned decision

The Board must clearly explain why a penalty is imposed and how the amount was determined. This creates transparency and allows the decision to be reviewed or challenged if required.

This ensures enforcement is procedural, transparent, and defensible.

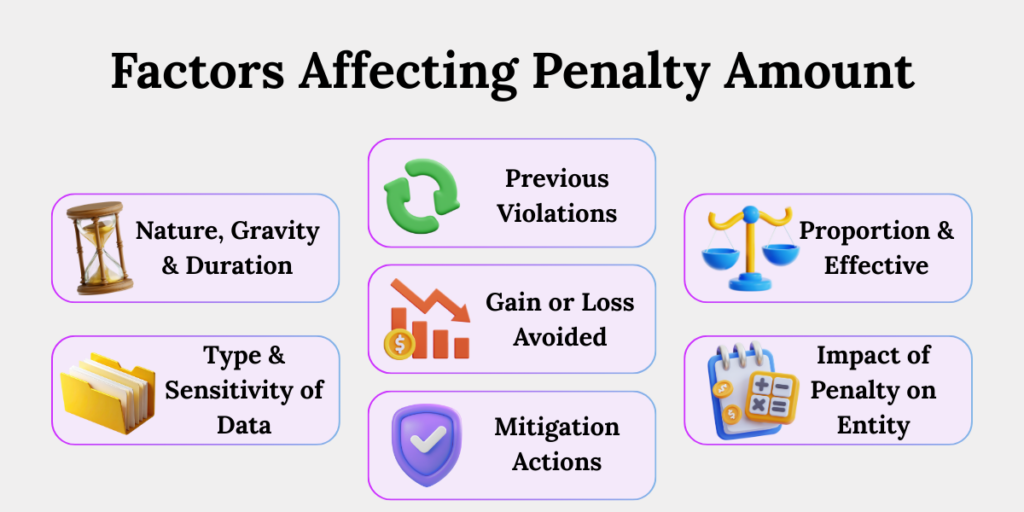

How Does the Data Protection Board Decide the Penalty Amount?

Section 33(2) sets clear criteria for deciding penalty amounts, using clearly defined factors.

Every penalty must be based on clearly defined factors, so organisations understand why a penalty was imposed and how its amount was decided.

1. Nature, Gravity, and Duration of the Breach

- Is the violation isolated or prolonged?

- Did it arise from oversight or sustained neglect?

- Did the breach persist after detection?

The Board assesses the seriousness and duration of the violation, distinguishing between a one-time lapse and a prolonged failure.

The Board also considers how quickly the organisation acted after detection, as delays indicate weak controls and increase penalties.

Longer and more serious failures attract higher penalties.

2. Type and Sensitivity of Personal Data Involved

- Ordinary personal data

Breaches involving ordinary personal data are usually treated as lower risk, especially if impact on data principal is limited. But penalties may still apply if the impact or scale is significant. - Sensitive personal data

Breaches involving sensitive information attract higher scrutiny because misuse can lead to financial loss, identity theft, or serious harm. - Children’s personal data

Violations involving children’s data are treated as high-risk by default. Even limited lapses can attract stricter penalties.

In short, the more sensitive the data, the higher the regulatory concern and penalty exposure.

3. Repetitive or Previous Non-Compliance

- First-time lapse vs repeat violations

First-time issues may be treated leniently especially if organisation is quick in mitigation actions, while repeat violations, indicate ignored warning signs which significantly increase penalties. - Pattern of disregard for DPDP obligations

Multiple related failures suggest deeper governance and control issues rather than accidental errors. Thus, stricter penalties apply.

In essence, compliance history matters — repeated failures are treated as organisational negligence.

4. Gain or Loss Avoided Due to the Breach

- Financial benefit from reduced safeguards

If the organisation saved money by avoiding investing in security measures or compliance infrastructure, this weighs against them. - Cost savings from skipped compliance measures

Skipping audit, assessments, documentation or monitoring in a measure to prioritise convenience over compliance is treated as an aggravating factor. - Competitive advantage through non-compliance

If an organisation gained speed, scale or market advantage by ignoring DPDP obligations, penalty is adjusted to neutralise this benefit.

The DPDP framework makes sure non-compliance never pays.

5.The DPDP framework makes sure non-compliance never pays.

- Speed of detection

Faster detection indicates effective monitoring & signifies organisation’s intent to minimise adverse effects on data principals, thus, reduces penalty exposure. - Timeliness of response

The organisation’s response time after detection in terms of prompt containment, communication, and corrective action demonstrate responsible handling and mitigate penalties. - Effectiveness of remedial measures

The Board evaluates whether corrective steps actually addressed the root cause of the issue. Superficial fixes that do not prevent recurrence does not help reduce penalty.

Thus, early, meaningful mitigation reduces exposure. Delay worsens liability.

6. Proportionality and Effectiveness

- Penalty must deter future violations

The penalty should be strong enough to prevent the organisation – and others – from repeating the same non-compliance. It should encourage long-term compliance, not just short-term correction. - Penalty must remain fair and reasoned

The amount imposed must match the seriousness of the violation and the surrounding circumstances. Penalties should not be excessive or disconnected from the actual breach.

In simple terms, penalties should be strict but fair – not random and excessive.

7. Likely Impact of the Penalty

- Organisational size and capacity

The Board considers the size, scale, and financial capacity of the organisation when deciding the penalty amount, ensuring penalties are meaningful, not disproportionate. - Business continuity considerations

Penalties are assessed to avoid unnecessary disruption to essential business operations. The goal is to enforce compliance without pushing viable organisations into operational instability.

In short, enforcement balances deterrence with long-term sustainability.

Maximum DPDP Penalties for Each Non-Compliance

Under the DPDP Act, penalties are not uniform. The Act specifies maximum penalty amounts applicable for different types of non-compliance.

This approach ensures fair penalties based on the seriousness of the breach.

| Type of Non-Compliance | Relevant Rule | What the Violation Involves | Maximum Penalty |

| Failure to implement reasonable security safeguards | Rule 6 | Weak technical or organisational measures, inadequate access controls, preventable data breaches | Up to ₹250 crore |

| Failure to report a personal data breach | Rule 7 | Delayed, incomplete, or suppressed breach notification to the Board or Data Principals | Up to ₹200 crore |

| Non-compliance with children’s data obligations | Rule 10 | Failure to obtain verifiable parental consent, prohibited tracking or behavioural monitoring | Up to ₹200 crore |

| Failure to meet SDF obligations | Rule 13 | Not appointing a DPO, skipping DPIAs, or failing to conduct mandatory audits | Up to ₹150 crore |

| Other contraventions of the DPDP Act | Section 33 + Schedule | Violations related to notice, consent, purpose limitation, or processing obligations | Up to ₹50 crore |

| Breach of duties of Data Principals | DPDP Act (Duties of Data Principals | Misuse of rights or submission of false information | Up to ₹10,000 |

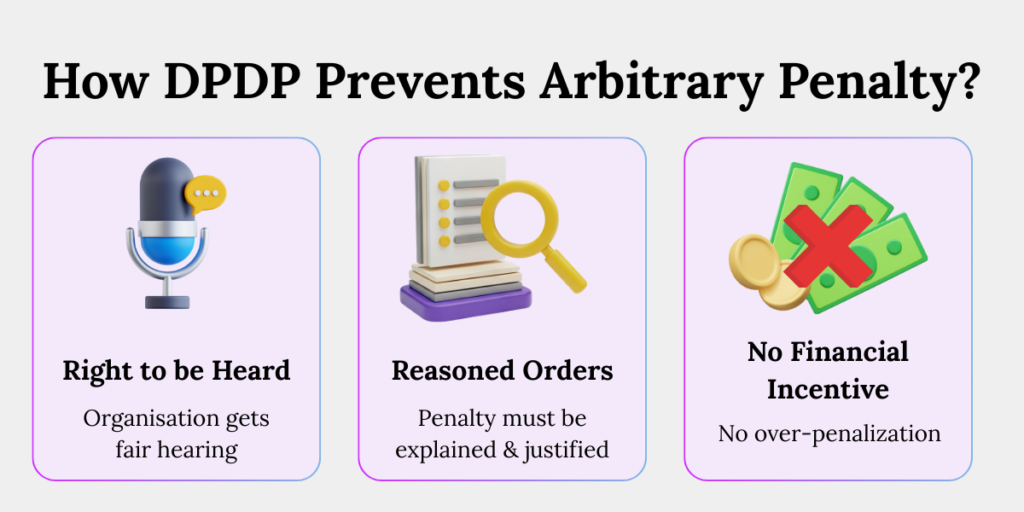

Does the DPDP Act Prevent Arbitrary Penalties?

Yes — by design.

The DPDP Act builds multiple procedural safeguards into Section 33 to ensure that penalties are fair, transparent, and evidence-based.

1. Right to Be Heard

Before any penalty is imposed, organisations are given a reasonable opportunity to present their case, ensuring penalties are not imposed on assumptions or incomplete information.

Organisations may:

- Present explanations

Entities can explain the circumstances that led to the violation, including operational challenges or external factors - Submit mitigating evidence

This includes records showing safeguards, internal controls, audits, or steps taken to reduce harm. - Demonstrate compliance efforts

Organisations can show that they acted in good faith, corrected issues promptly, or improved controls after detection.

This process ensures the Board considers context, intent, and corrective action, not just outcomes.

2. Reasoned Orders

The DPBI must issue reasoned and documented decisions. Penalties cannot be imposed without explanation.

The Board must:

- Record findings

Clearly state what violation occurred and how it was established. - Explain penalty calculation

Outline how statutory factors under Section 33(2) were applied. - Justify proportionality

Show why the penalty amount is appropriate for the seriousness of the violation.

This makes penalty decisions transparent, reviewable, and defensible.

3. No Financial Incentive

Penalties are credited to the Consolidated Fund of India. The Board retains no financial benefit.

This removes any financial motivation to over-penalise and ensures enforcement remains neutral and objective.

How to Avoid DPDP Penalties?

Organisations can avoid DPDP penalties by assigning clear accountability, strengthening security safeguards, maintaining audit-ready records, and responding quickly and transparently to incidents.

The DPDP framework rewards preparedness and good-faith compliance, not perfection.

Let’s dive deeper.

1. Governance and Accountability

- Assign DPDP ownership

A specific individual or function must be responsible for DPDP compliance. When accountability is unclear, gaps go unnoticed and violations escalate. - Define internal responsibilities

Teams handling data, security, legal, and IT should have clearly documented roles. This prevents confusion during audits or incidents. - Maintain written compliance frameworks

Policies, procedures, and internal guidelines provide evidence of structured compliance. Written frameworks show that compliance is intentional, not ad hoc.

2. Security and Breach Preparedness

- Implement reasonable safeguards

Organisations must apply technical and organisational measures suited to the data they handle. Weak or outdated safeguards increase penalty exposure. - Maintain breach response playbooks

A predefined response plan ensures faster action during incidents. This reduces harm and demonstrates readiness. - Test incident readiness periodically

Regular testing helps identify gaps before real incidents occur. Preparedness is viewed favourably during enforcement.

3. Audit and Evidence Readiness

- Maintain logs and records

Logs provide traceability of data processing and security actions. They help demonstrate compliance during inquiries. - Conduct internal assessments

Periodic reviews help identify risks early and correct them before they escalate. - Prepare inquiry-ready documentation

Clear, organised records allow organisations to respond quickly to regulatory inquiries. Delays or missing evidence weaken defence.

4. Timely Mitigation and Cooperation

- Act immediately on incidents

Clear, organised records allow organisations to respond quickly to regulatory inquiries. Delays or missing evidence weaken defence. - Communicate transparently

Honest and timely communication with the Board and affected individuals signals responsibility. - Demonstrate good faith compliance

Cooperation, corrective action, and openness are strong mitigating factors under Section 33.

Compliance delayed is compliance denied.

Conclusion

DPDP penalties under Section 33 are meant to enforce accountability, not create uncertainty. Penalty exposure depends on risk, impact, compliance behaviour, and response, not intent alone. Organisations that build clear ownership, strong safeguards, proper documentation, and timely incident response can significantly reduce enforcement risk. Good compliance prevents penalties – and builds trust.

Key Takeaways

- DPDP penalties exist to enforce accountability, not to punish randomly.

- Section 33 gives the Data Protection Board of India the power to impose penalties.

- DPDP penalties apply to Data Fiduciaries, Significant Data Fiduciaries, and in limited cases, individuals.

- Penalties can be imposed even without malicious intent.

- Penalty amounts are decided using defined statutory factors like

seriousness, data sensitivity, compliance history, mitigation efforts, and proportionality. - More sensitive data means higher penalty exposure.

- Repeat non-compliance significantly increases penalties.

- The DPDP penalty framework ensures non-compliance never pays.

- DPDP penalties are not arbitrary, giving organisations the right to be heard, receive reasoned orders, and face neutral enforcement.

- Most DPDP penalties are preventable; by having clear accountability, strong security safeguards, audit-ready documentation, and timely incident response significantly reduce risk.